Coverage

Life Plan

Making Sure Your Care Is Covered

You may be wondering why you should be considering a senior living community that offers Type B contracts, particularly if you have health insurance and Medicare. Many individuals looking at senior living communities assume that their healthcare insurance and Medicare will cover their long-term care costs, including assisted living services, skilled nursing, and memory care.

In reality, healthcare insurance doesn’t cover any long-term care. What’s more, healthcare insurance, including Medicare, does not cover housing. Many do not cover assisted living services, skilled nursing or memory care, or offer limited coverage for those levels of care.

It’s important to understand what exactly your healthcare insurance will and will not cover, to protect your assets and ensure you receive the level of care you need today and tomorrow.

Comparing Coverage

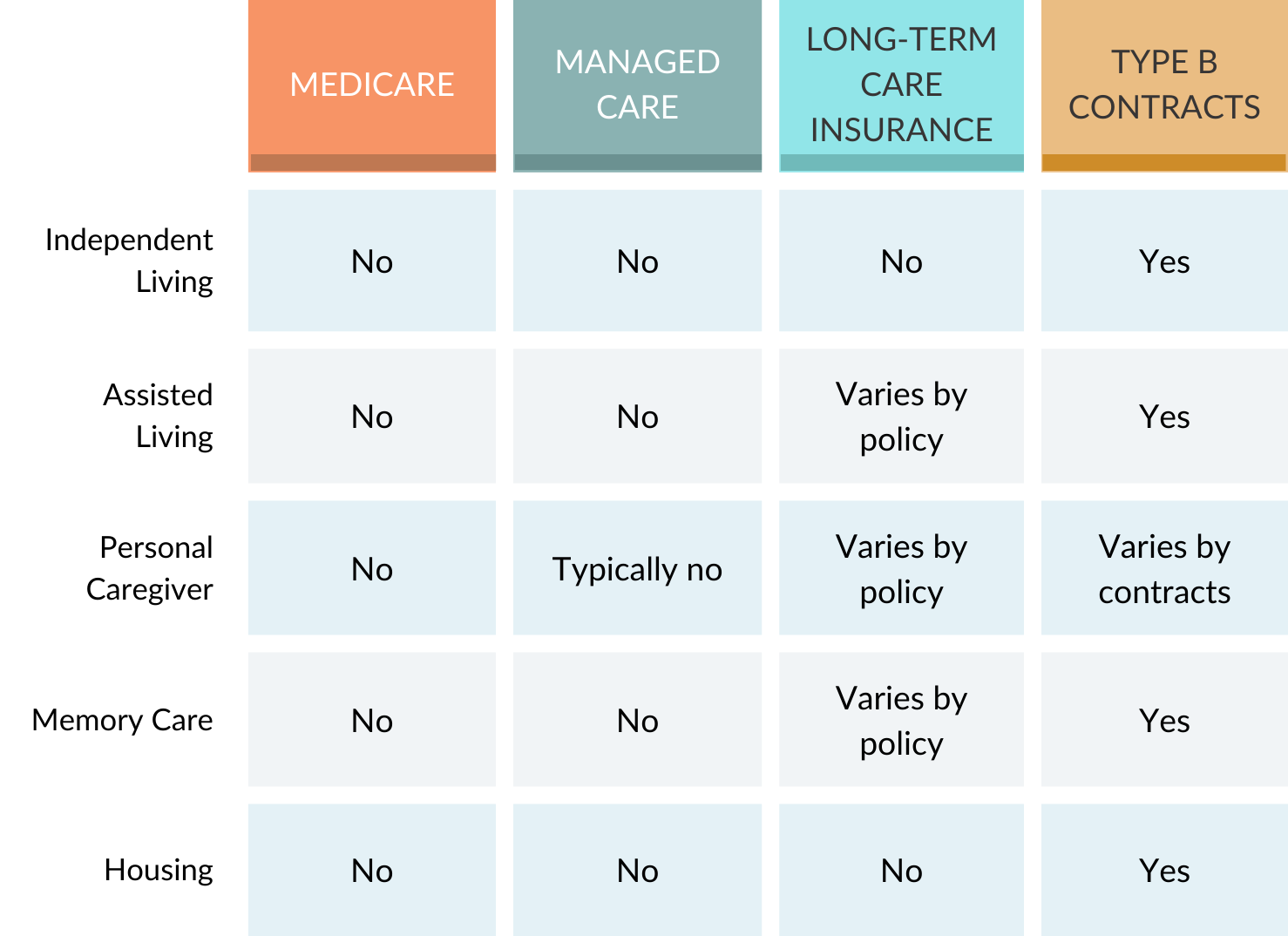

The chart below shows which services are and are not covered by different types of healthcare insurance.

Americans are living longer and longer. As a result, more people are turning to long-term care insurance to help cover the costs for future care that Medicare doesn’t cover. These costs include in-home care, assisted living, memory care and skilled nursing services they may need later in life.

Long-term care insurance can help preserve your assets, relieve the family of a financial burden, and enhance freedom of choice when it comes to where and how care is delivered. But it also comes with daily and lifetime caps on what it covers. Once you reach those caps, you are responsible for covering the remaining costs. With the rising costs of assisted living and skilled nursing, those caps can be reached much sooner than you might think. What’s more, long-term care insurance does not cover the cost of housing. Some long-term care policies do not cover in-home care either.

When paired with long-term care insurance, Type B contracts provide the most comprehensive coverage for a lifetime of care. This is because Type B contracts have no daily or lifetime caps, while keeping monthly costs stable. If you exhaust the coverage limits on your long-term care insurance, Continuing Care and Continuing Care Enhanced contracts continue to cover you. For those without long-term care insurance, these contracts offer the best option to ensure on going care while maintaining predictable monthly expenses.

Is a Type B Contract Right for You?

When deciding which type of contract is right for you, make sure you’re asking the right questions. Click here for a list of questions to help you determine if a buy-in contract meets your needs.

Common Contract Types

Senior living community contracts vary greatly. Be sure to read and compare contracts closely before you make a decision. Learn more about the most common contracts offered by Continuing Care Retirement Communities (CCRCs).

We’re Here to Help

We understand that choosing the right senior living community isn’t always simple. We’re here to help make it easier, with information, guidance, and peace of mind. If you have any questions about Continuing Care Retirement Communities, buy-in contracts, or long-term care, please don’t hesitate to contact us today.